When it comes to House Hacking and real estate investing, many people find themselves entangled in a web of misconceptions and contradictory advice. The alluring prospect of timing the market and concerns about high-interest rates can leave aspiring investors on the sidelines; often the worst place they can be with their investments. These worries or the advice from well-meaning friends can lead to an underperforming “wait and see” approach. This approach drastically underperforms another strategy we will talk about today – costs averaging. We’re going to take a deeper dive into these notions and explore why cost averaging is the most sensible approach to House Hacking. To illustrate this, we’ll examine real-life data from the Colorado Springs market.

Misconception 1: Timing the Market

The idea of “buying the dip” in the real estate market is akin to trying to catch lightning in a bottle. Just as in the stock market, timing the real estate market perfectly is a feat that few achieve. The truth is, no one can consistently predict market movements. As an experienced real estate agent, I often encounter clients who say, “I’ll just wait for the right moment.” But the question that begs to be asked is, “Wait for what?”

Misconception 2: Waiting for Lower Rates and Prices

Many would-be investors hesitate, waiting for interest rates or property prices to drop. However, this waiting game can become a never-ending ordeal. There’s no guarantee that rates or prices will align with your expectations, and even if they do, it might not happen when you expect it to.

The Power of Cost Averaging

If your goal is to scale your real estate investments and secure a property every year, cost averaging is the strategy you should adopt. Cost averaging involves investing equal amounts of money at regular intervals, such as purchasing a property every year. This systematic approach ensures that you buy during both highs and lows in the market.

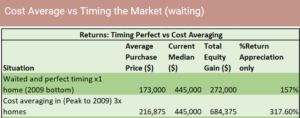

To demonstrate the effectiveness of cost averaging, I’ve gathered data from the Colorado Springs market. Let’s take a closer look at the numbers.

Data Analysis: Colorado Springs Market

Let me explain this chart of returns. It’s showing the total equity gain of two different scenarios. It’s the amount your home(s) would have appreciated in each of these scenarios. I chose these dates intentionally as they are before and during the biggest National Real Estate market downturn in recorded history. House prices started skyrocketing in 2005. They peaked in 2007. The trough for most of the country’s real estate markets was in 2009.

Here are the two scenarios:

Scenario 1: Imagine you were contemplating buying a property in 2005 and chose to wait until the market hit its lowest point in 2009. If you had taken this route, your return on investment would have been a commendable 157%. It might seem like you successfully timed the market, but hold on.

Scenario 2: . Let’s say you timed the market terribly and bought your first property at the peak of the market in 2007. Luckily for you though, you were able to cost average in on the way down. By 2009, you would have acquired three properties at an average price of $216,875. Your total equity in these three properties today would be $684,375, resulting in an impressive total appreciation of 317.60%.

You might argue that comparing three homes to one isn’t entirely fair. However, this comparison highlights a crucial point: when you wait and attempt to time the market, you miss out on opportunities to grow your real estate portfolio.

The Perils of Well-Meaning Advice

It’s essential to be cautious about the advice you receive from friends and family, no matter how well-intentioned they may be. Real estate investment is a nuanced field, and not all advice is created equal. Those offering advice might not fully understand your long-term vision or your unique investment strategy.

The Colorado Springs data exemplifies the power of cost averaging in real estate investing. Attempting to time the market is a risky gamble that often leads to missed opportunities. By consistently investing over time, you can build a more robust and profitable real estate portfolio.

Conclusion:

As you embark on your real estate investment journey, remember that not all advice is created equal, and it’s crucial to consult with experts who understand your goals and can guide you effectively. In the dynamic world of real estate, cost averaging remains the most reliable strategy for those looking to scale their investments and achieve long-term success.

If you are worried about rates, I work with lenders that will offer a 1 point rate buydown and a free refinance in the future. You can refinance when/if rates go down. Don’t wait to buy.

If you are worried about prices and still think trying to time the dip is the best strategy (it’s not), they dipped 10% in Colorado Springs from April 22′ to December 22′. The median price is up from January 2023. Now may be the dip you were hoping for.