When looking for a good house hack I consider a couple things.

- Will it reduce my cost of living when compared to renting?

- What is my net worth ROI on my downpayment and is this better than other investment opportunities I have access to.

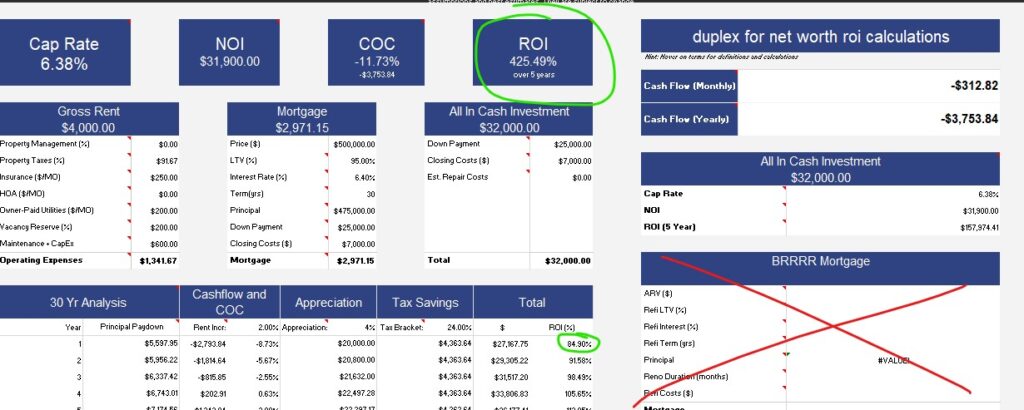

Your Net Worth ROI calculation takes into account the appreciation, loan paydown, tax benefits, and the rent avoidance (the difference in what you pay towards your mortgage compared to your rental situation). The total of that number over the year divided by your 5% down payment is your net worth ROI. Because you are getting the home for 5% down and hopefully holding for the long term, you will almost certainly be get a better ROI than the ROIs you can get elsewhere in the investing world.

That is what I look for. Now, how do I calculate the Net Worth ROI? I have a great calculator to help figure this out.

The inputs for the image in this screenshot are as follows:

500k purchase price duplex.

Rent each side for 2k/month (this is after you move out)

5% down payment

Closing costs: 7k

6.4% interest rate

Insurance: $250/month

Utilities (paid by owner): $400/month

Vacancy budgeting: 5% of monthly rent

Maintenance budgeting: 8% of monthly rent

CapEx budgeting: 7% of monthly rent

Even though you are negative $312/month after budgeting for future expenses, your net worth ROI is massively positive. Real estate is one of the best ways to build long-term wealth. And house hacking is an incredible way to get started with only 5% down. Your net worth ROI over 5 years is 425% and your ROI in year one alone is 84.9%. Where can you beat those returns?!